|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Home Refinance Rates in California: Key Insights and TipsRefinancing your home in California can be a savvy financial move, but it's important to understand the nuances of refinance rates in this unique market. This article will guide you through the essential information you need to make an informed decision. Factors Influencing Refinance RatesSeveral factors can affect the refinance rates in California. It's crucial to understand these components to get the best deal. Credit ScoreYour credit score plays a significant role in determining your refinance rate. Generally, a higher credit score can help secure a lower interest rate. Loan-to-Value RatioThe loan-to-value (LTV) ratio is the amount of the loan divided by the appraised value of the property. A lower LTV ratio can result in better rates.

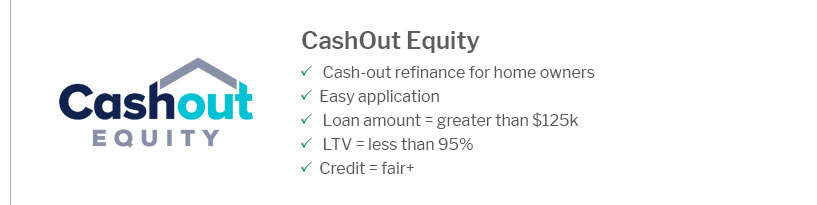

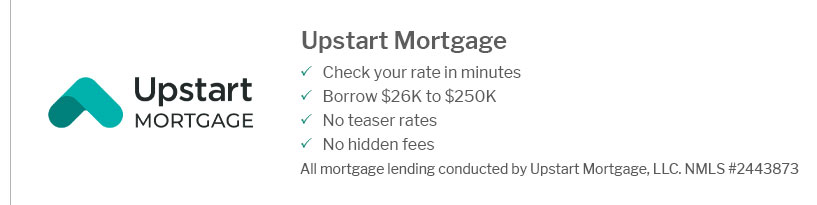

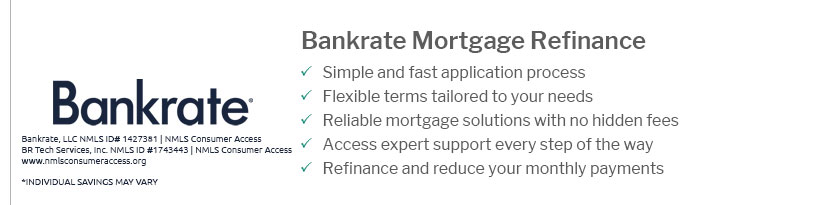

Types of Refinance LoansThere are different types of refinance loans available. Choosing the right one depends on your financial goals and situation. Rate-and-Term RefinanceThis type of refinance changes the interest rate or the term of your existing loan without altering the loan balance. Cash-Out RefinanceAllows you to take out a new mortgage for more than you owe and pocket the difference in cash, potentially at a higher interest rate. Comparing Refinance OffersWhen comparing offers, consider the current lowest mortgage rates available. It's essential to shop around to find the best deal.

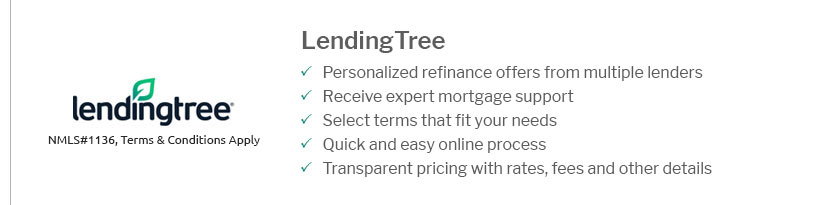

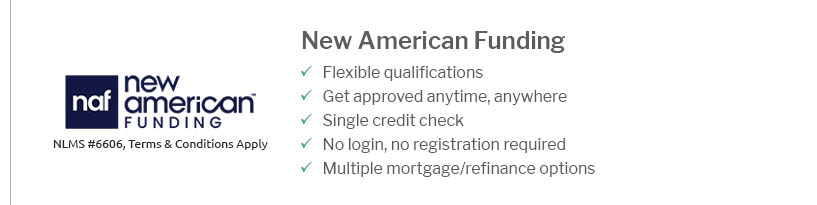

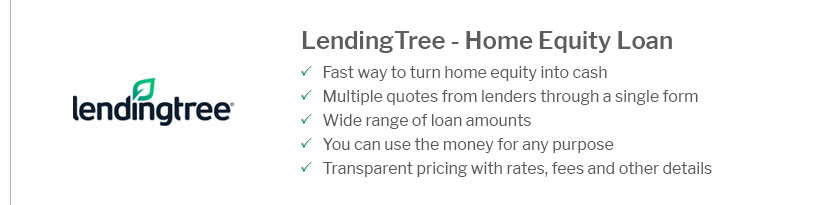

Using online comparison tools can simplify this process and ensure you get the most competitive rate. FAQ

ConclusionUnderstanding refinance rates in California requires awareness of various influencing factors, loan options, and market trends. By staying informed and exploring multiple options, homeowners can make decisions that align with their financial goals. https://www.golden1.com/credit-cards-loans/home-loans/rates

30-Year Fixed Conforming Refinance ; 6.125%, 6.736%, 0.125 ... https://www.alpinebanker.com/mortgage-rates-ca

Below are today's purchase and refinance mortgage rates on our conventional, FHA and VA loan programs for homes in California. https://www.zillow.com/refinance/ca/

The current average 30-year fixed refinance rate rose to 7.19%. California's rate of 7.19% is 11 basis points higher than the national average of 7.08%. Today's ...

|

|---|